Marc Ostrofsky is likely best known as the domain name investor who bought Business.com for $150,000 and sold it for $7.5 million a mere four years later, earning him an entry in the Guinness Book of World Records. But he’s also founded five magazines, 12 trade shows and seven companies, selling businesses cumulatively worth over $100 million.

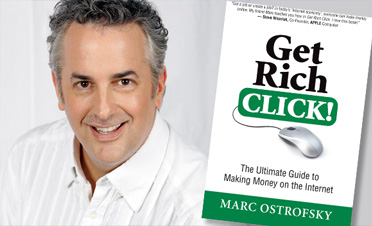

Despite the title, Get Rich Click!: The Ultimate Guide to Making Money on the Internet, this is no get rich quick scheme. Instead, this book arguably contains the most comprehensive and diverse information source available for making money on the Internet, and it’s written by one of the world’s most successful Internet entrepreneurs.

I spent about an hour asking Marc Ostrofsky to dissect the strategies and tactics in his book and tell you exactly how you can make money on the Internet. And Marc is a fantastic storyteller who illustrated his points with examples that you will remember long after this interview is over. Watch this video now. Trust me.

Interview (49:50): Watch | Listen/Download Audio | Sponsors | Key Take-Aways | Read Transcript

Your DomainSherpa Interview

If you like this program, please thank Marc on Twitter (click here – opens in new window)

![]() Bonus Advice from Marc Ostrofsky

Bonus Advice from Marc Ostrofsky

Your DomainSherpa Interview, Audio Only

Note: Adobe Flash Player (version 9 or above) is required to play this audio clip. You also need to have JavaScript enabled in your browser. Or, listen on iTunes or in your favorite podcast app (here are the feeds).

About Marc Ostrofsky

Marc Ostrofsky is the author of Get Rich Click!: The Ultimate Guide to Making Money on the Internet, The Razor Media Group (May 2, 2011). Order the book through the Get Rich Click website and receive three free gifts: 1) Over $500 in FREE advertising credits (Google, Amazon, Myspace and more), 2) 1 month of access to Marc’s Expert Interview Series ($49 value), and 3) A FREE copy of Marc’s A to Z Rules of Online Success ($9.97 value).

Marc is a professional speaker, consultant, venture capitalist and serial entrepreneur. Known as a “Technology Wildcatter,” he founded the Prepaid Phone Card industry and was an early pioneer in the Voice Mail Industry, Pay Phone Industry, Prepaid Cellular Market and other deregulated telecommunications markets. He created numerous magazines, trade shows and market research studies and later sold those firms for $50 Million+. He is one of the few keynote speakers and authors that actually owns a portfolio of highly profitable online business ventures. His current Internet companies generate $75 Million+ annually and include Blinds.com, CuffLinks.com, SummerCamps.com, eTickets.com, MutualFunds.com, Photographer.com, Consulting.com, TechToys.com, BeautyProducts.com, Bachelor.com and others.

Marc is one of the leading experts on making money online and teaches businesses how to compete effectively in the new digital world. He is known for selling the domain name Business.com for $7.5 million which landed in The Guinness Book of World Records as the most expensive domain name ever sold. He then invested in Business.com which later sold for $345 Million.

![]() Follow Marc Ostrofsky on Twitter

Follow Marc Ostrofsky on Twitter

![]() Follow DomainSherpa on Twitter

Follow DomainSherpa on Twitter

Interview Advertisers

DomainTools is the recognized leader in domain name intelligence, providing a powerful set of research and monitoring tools built on the industry’s freshest data. DomainTools offers the most comprehensive collection of domain name ownership records in the world. Over 1 million members rely on DomainTools to protect and grow the value of their web sites, their domain names and their intellectual property on a daily basis.

SEOConsultant.com provides the SEO advice you need to take your developed domain name from page 2 (or worse) to the first page of organic search results on Google or Bing. Ask questions and receive answers within 24 hours. Build long-term value – and generate monthly EFT paychecks from Google – by search engine optimizing your domain name websites.

Marc Ostrofsky Interview Key Take-Aways

- While Marc often receives accolades for the sale of Business.com, he sold another domain under non-disclosure agreement the same day. eBusiness.com sold to the competitor of eCompanies, the company that acquired Business.com. The price? A cool $10 million.

- When Marc sold his first media company, he thought he would get $8 million. By hiring the best people he could (e.g., lawyers, accountangs, etc.) – the people who have made mistakes and have years of experience – he was able to sell it for $35 million.

- Competing offers drove the price of eBusiness.com from $1 million to $10 million.

- Blinds.com, a company that Marc owns, was originally called NoBrainerBlinds.com. “We take the order. We electronically send it to the manufacturer. They print, they make them custom and drop ship them — we don’t touch the product.” Today Blinds.com has revenue of more than $75 million per year and sells twice as many blinds as their closest competitor.

- You do not need to own inventory of the products you are selling. Example 1: take a picture, sell the product. Example 2: Marc visited a sorority house at the University of Texas, where he was in college…watch this interview for the details.

- Buy the book from the Get Rich Click website and receive $500+ in credits. Then use arbitrage (described in the interview and book) to make money on the spread – between the buy price of the advertising and sell price of the customer interest/leads.

- There are certain domain names that you should hold on to because they will go up in value. The qualities include: the name of an industry and the .com extension.

Marc Ostrofsky Interview Raw Transcript

![]() Marc Ostrofsky Interview Transcript in PDF Format (Right-click to Save As…)

Marc Ostrofsky Interview Transcript in PDF Format (Right-click to Save As…)

Watch the full video at:

https://www.domainsherpa.com/marc-ostrofsky-getrichclick-interview

Michael: Hey everyone, my name is Michael Cyger. I’m the publisher of DomainSherpa.com, the domain name authority.

Today, I’m excited to have a true domain name pioneer on the program. Joining me is Marc Ostrofsky. Marc is an entrepreneur, speaker and venture capitalist. He founded, built and sold over $100,000,000 of businesses starting with only a $5,000 car loan. He’s well known for his record sale of the domain name Business.com in 1999 for $7,500,000 which landed him in the Guinness Book of World Records as the most expensive domain name ever sold. Business.com was sold again in 2007 for $345,000,000, earning Marc another $2,500,000 plus.

But Marc’s list of achievements only starts there. He was the only pioneer and founder in the voicemail market. He founded the prepaid phone card industry. He founded five magazines. He founded 12 trade shows and founded seven companies. He currently owns stakes in over 150 websites including Blinds.com, Cufflinks.com, Etickets.com and SummerCamps.com. He also has a premium domain name portfolio including Bachelor.com, MutualFunds.com, Photographer.com and Consultants.com. Marc has appeared in hundreds of media outlets, including in The Today’s Show, ABC’s 20/20, The Wall Street Journal, The New York Times, and USA Today.

He’s also the author of Get Rich Click, the ultimate guide to making money on the Internet which includes 17 chapters and 272 pages of ideas, tips, strategies and actionable tactics for making money on the Internet. And as you can see, I’ve got quite a few identified in my own personal copy. Welcome Marc, it’s my honor to have you on the show.

Marc: Thank you very much. It’s lovely to be here.

Michael: Marc, you have a “who’s who” of endorsements on this book. Right on the front cover, I see Steve Wozniak “The Woz”, co-founder of Apple Computer. He says, “Everyone can make money online. My friend Marc teaches you how in this book.” Dr. Stephen Covey, you know, one of my all time favorite, 7 Habits of Highly Effective People says, “This easy to follow book will teach you the ropes to achieve financial success.” Stephen Covey said that. You’ve got other endorsements all over this place. You’ve got my favorite guerrilla marketing guy Jay Levinson inside. You’ve got Jack Canfield, author of Chicken Soup for the Soul. Fantastic endorsements. What makes this book so unique?

Marc: Probably the first thing is I do it. Most people write the books and haven’t done it and so I didn’t want to come out first, I wanted to come out best. And so I took five years to write the book, five years I’ve been working on this thing and a lot of that was because the market changes so fast, you got to update. But those people know me, have met me over the years and know what I’ve been working on and I sent them drafts before I got it done. And if you look at the book, just as you have done, you’re in the business and you’re saying, “Wow, this is a helpful book.” And the reason it is, is we took very meticulous action to give details and not a bunch of junk, so pick a page. The 32 ways to pay for a product, you know most people know Pay per Click or Pay per Sale. We found 32 ways that you can buy and pay for an item online, so it’s attention to detail and it’s more of a way of giving back to the industry because you don’t make money in the book business, you know. It’s just not a profitable venture.

Michael: Right.

Marc: So, it is what it is.

Michael: It is. Alright, let’s start off with one of the first ideas in your book. You say there are only a certain number of ways to rich in life. Tell us what they are.

Marc: Oh man, you’re going to make me refer back to my writing. We put inherit it, which is obvious, marry it and I went through that in my first divorce, she did really well. Invest, you can invest money to get rich, that’s obvious. You can get lucky, you can win the lottery or some other lucky event. Number 5 is you can work for a company and that’s the hardest way with respect to the day to day person but it depends on who you work for and what you get paid, do you get paid options or any other way of getting compensated. You can break the law, you can steal the money, you can be a drug dealer or you can con people. Unfortunately, there’s lots of those but that’s not an honest way to get wealthy. And the way that I chose and the way that I profess is entrepreneurship. And entrepreneurship is brain power and it’s understanding a market, understanding a niche, understanding the players you are playing with and against. And I literally spend more time when I’m competing, learning about my competitors than I do my own product. And so we say there are only seven ways and I defy anybody to come up with another way that you can make money and get wealthy other than in that list of seven.

Michael: Great, in your book you discussed a lot of topics like website optimization, reverse commerce, advertising, affiliate marketing. Do all the topics center around domain names? In other words—

Marc: No, no, no, not at all.

Michael: Not at all, you don’t need to own a domain name in order to play in any of these spaces or follow the ideas in the book?

Marc: Well, let’s compare one of the chapters is about comparing a domain name to real estate and let’s start there if I may. Because the domain name, we trademarked or quoted as the people who created the statement domain names are Internet real estate. And that was back in ’94 when I acquired Business.com and we said that in our press release. And I firmly believe that’s the basis of the building, the domain name. Then you can build whatever you want on top, a house, a skyscraper, a storage unit, whatever it may be. So, the book is not about domain names, it’s about how to get rich using the Internet as the medium. Domain names are an integral part of it but they’re passé in many ways to other people. They’re like, yeah, I’ll get a domain, that’s no big deal. But once I own the domain, the real action is how to make money from it. So it’s not a domain book at all. It’s just got 1 chapter on domains.

Michael: Right, but it’s all integrated like you can use domains with all of the ideas of the book?

Marc: Let’s put it this way. You can’t do anything without the domain or a domain. You could still get rich using Facebook without a domain name though. I’ve got in there ways to make money with Facebook and YouTube and other social media sites without a domain. But having a domain and using the domain is integral to the real estate business. You can make money in real estate, buying and flipping and never taking possession or being a middle man, but that’s not the essence of the real estate business but you could say you’re in the real estate business. So, I get pass that and say domain names are simply the dirt at the bottom of the building. But you can buy and sell that dirt and make a whole life’s living in the domain space and I’ve been doing that for a long time.

Michael: Great, okay, so I’m going to dig into your book but first I want to take a step back for a moment, ask you a few questions about Business.com, the transaction. Most domain investors would kill to have a domain name like Business.com and they can only dream of a sale, of the magnitude. Was Business.com the highest you’ve ever paid for a domain name?

Marc: Yeah, I think so. I bought Consulting and Bachelor in a group of names but I think the individual was $150,000. I paid that for another name but in relatively it’s about this most I’ve ever personally paid for a name.

Michael: Okay, and was it the highest transaction you’ve ever sold it for?

Marc: No.

Michael: Really? You’ve sold a domain name for higher than 7.5 or 10 million dollars cumulative?

Marc: I got $10,000,000 the same day for another domain.

Michael: Wow, are you at liberty to say what that domain was?

Marc: Well, it was under nondisclosure at the time, I don’t know today if that’s still applicable or it makes a difference but I sold Business.com the same very day I sold eBusiness.com to their competitor.

Michael: Wow, what was it like to negotiate a deal or deals of that magnitude?

Marc: You know what, it was 30 days after I sold my company for $35,000,000. I was on a high at the time, it didn’t make a difference. But it was just like the best 35 days of my life. I had sold the first company for $35,000,000 cash and we are on a trip celebrating that event, we’re in Mexico with my lawyer and his wife and some other friends and they started negotiating on Business.com. We say to one, they offered a million, well I’ll offer two, well I’ll offer three, well I’ll offer four and we got one up to 7,500,000 and one to 10,000,000 and we sold them the same day.

Michael: Unbelievable. And so on your, when you had your media company and you sold that for 35,000,000, you didn’t do the negotiations on that, you had a broker right?

Marc: That’s correct. It’s not a broker, I had an investment banker.

Michael: Okay.

Marc: The key is knowing what you don’t know. It’s a big philosophy in my world in everything I do. And I hire the best lawyers, the best accountants, the best of the people I deal with because they know and have made the mistakes and they usually have years of experience. I thought we’d get $8,000,000 for the company. They had 5 bids 8, 12, 20, 28 and 35 all for the same company, the same ibadah and the same ibadah’s we sold for 35,000,000 and I got that in cash upfront and then this deal came within 30 days of that while we’re celebrating the first one, we negotiated the sale of the second one.

Michael: And did you actually, so the domain names business was different, you know, it was basically a domain name, an asset. Did you use an investment broker or some sort of broker to do that deal as well?

Marc: No.

Michael: You did it yourself?

Marc: Yeah, and actually – well no one had ever done that. No one ever bought a domain name for that kind of money. I had an agreement to buy it from the gentleman in London for $75,000 and I went to my father who’s a business professor and said, “Do you think I should do this?” And his comment was, “Do you have the money?” I said, “Yeah.” He said, “Do you need that money for another investment?” I said, “No, it’s in the bank earning interest.” He said, “How much interest do does it earn?” I said, “2%.” He said, “Can you make more than 2% with the other asset?” I said, “Yeah, I think so.” So I went back to buy it and the guy bumped the price from 75 to 150 on the day of the night before the sale. And so when I sold it for $7,500,000 he was the first person I let know.

Michael: So you didn’t actually even own the domain name, you sold it before you bought it.

Marc: No, no, no, no, no, I bought it in ’94. And when I bought it, the guy screwed me the night before I bought it.

Michael: Got you, the night before.

Marc: And I held it planning to build a magazine called Business.com, because I saw the Internet as a business medium where as it was mostly being used for sex and for information but not for business. And I saw the Internet as a business commerce site. And in fact, I’ll tell you something that I’ve not told another journalist, if you go to the USPTO Patent and Trademark Office and type in .com, you will see that I filed a trademark on .com. The trademark office couldn’t understand what it was. They couldn’t grant it because they didn’t know what I was talking about but I do have it on filing way back when.

Michael: Yeah, I actually went to the USPTO yesterday, whereas I was preparing for this interview and I typed in your name and I saw that you’ve registered Business.com, you tried to register a bunch of other things and I saw that tried, you put in a trademark registration for .com as a business magazine.

Marc: Yeah I—

Michael: I was going to ask you about that.

Marc: Well, I really wanted it just so I could get a dollar a year from every domain owner. That was the real goal. It didn’t work but I tried.

Michael: Love it.

Marc: And I figure if you don’t try, you got no chance.

Michael: Love it. So, when you’re selling Business.com and eBusiness.com, how do you even know where to start in negotiation? It’s a magnitude that nobody has ever been at before. You start at 10,000,000 million, negotiate down to 7,500,000? Do you—

Marc: No, no, no, not at all. We had an offer of a million and I called this competitor who I knew and said that he wants to buy it for a million, the guy said I’ll buy two. They were flush with cash. This is in the day when they raised hundreds of millions on ideas and as they used to say, you could stick your finger in the ground in Silicon Valley and up pull your finger was $100 bill attached.

They had that kind of money. So, two and then it got to three and then it got four and I did the same thing the investment bankers do. I kept going back and forth until I had it and they were both at the pressure point and they both said that’s it. And one of them luckily said, “Okay, I’ll tell you what, I’ll pay you 10 million but I want eBusiness.” I said, “Okay, I’ll do that.” And so the surprise was the other one was under nondisclosure and we didn’t disclose it and that was what we ended up with.

Michael: Amazing. And so the money transfers into your bank account via wire. You closed both transactions.

Marc: No, that’s not the way it went down, and in the book it says that. I put a put right, I had done another deal where, do you know who Pinky Brand is?

Michael: Yes.

Marc: Okay, so Pinky and I were partners and when we sold that company, Pinky got options or rights to buy stock in the future, I didn’t and he made a lot of money doing that, I didn’t do that because he went with the company, I didn’t. So I said, you know what, I’m going to learn from my mistake, because that probably cost me $5,000,000 or $10,000,000 million dollars, that one error cost me that much money, because had I known the options were free, I could have asked for them and I didn’t. So this time I said I want a put right and a put right for any of those of you who don’t know means I have the right to transfer money or stock whichever I buy with money or stock at a certain date. So it said, the deal is for that amount of money, the deal is closed. Now, I’m flushed with cash, I don’t need the cash today, I have a right in the future to take cash or stock, let’s wait and see how the company does. If the company does really great, I can make a lot more money.

Which is what I did. The actual numbers were never disclosed and actually the number you talked about wasn’t actually correct, I got more than that when it closed. I own 3% of Business.com. You can do the math; it’s sold for 345,000,000. So, it wasn’t $2,000,000 when the company was sold, it was over $10,000,000.

So, if you took the cash I got and the stock I got, it was well over what they sold Sex.com sold for. And they’re claiming that was the biggest, these guys just lie through their teeth and we’ll leave it at that. They announced the same $13,000,000 several times and it was proven in court they lied, because they got into an argument and that reality got to hit the court level and they didn’t sell it for $13,000,00, it was all fiction, but the guys behind it wanted the publicity so that’s what they announced.

Michael: Got it.

Marc: So, it is what it is.

Michael: I want to try and spend as much time as we can talking about your book, Get Rich Click. I’m going to run people through some chapters that I thought were really interesting and useful for people. Give everybody an idea of what they can expect when they buy this book. So, in Chapter 1, you talked about creating a mind set to get rich. What is the Get Rich Click mind set?

Marc: You have to kind of know what you don’t know. Don’t think you can do it all and if you can’t do it, I’m sitting here with my partner who’s a tech guru today right before you called for three hours learning more about Skype and learning about my new cell phone. We actually took a picture, it’s the funniest picture. I’ll see if I can show it. We took a picture of us trying to sync all of our products right? I’m going to see if I can show you this. It’s the funniest picture, hold on.

Michael: And I love this because—

Marc: Let’s see if you can view the picture.

Michael: I can see that, and I love it because now, everybody that’s downloading this interview and listening to it while they’re working out is going to have to come back and watch the video to see what the picture that’s on your phone.

Marc: That picture is an iPad, two laptops, two computers and a phone and a new iPad trying to learn how to sync them all. But you know, you know very few people can do it all. So my partner is really good in what I’m not and I’m pretty good in what he’s not and it works but you got to find that relationship to really make things click. And I don’t mean that in a funny sense because of the name of the book but it’s true, they got to click. So you hire your weaknesses and know your limits and know you don’t know it all and find people who know more than you do. That’s a very important mindset. And I deal with a lot of kids, they’re going, I want to make money, I want to make money, I want to make money. That’s not how you need to think, money is what keeps score but the real game is knowing what you don’t know and filling in your weaknesses so you have the best chance of success.

Michael: Makes sense. Alright, in Chapter 2 you talked about an idea called reverse commerce. Can you tell everybody what reverse commerce is?

Marc: It’s reverse ecommerce and let me back up before I got forward. I invested and became a partner in a company that was selling blinds online. My friend called it NoBrainerBlinds.com. I said…

Michael: That was the domain name that they launched under when they first started.

Marc: And they had a retail, two retail sites here in Houston. The retail sites did a $1,000,000 with a $100,000 in profit, the two sites together whereas the online site did $1,000,000 and had, you know $500,000 in profit. The numbers weren’t even close, one you could grow and one you couldn’t in a big way. So, I said, I’ll invest, I’ll find other investors. I’m on the board, we control the company, you and I, but we must buy Blinds.com as part of the deal and rename the company. Today, that company does over $70,000,000 online and we have no retail. Now, let’s answer your question. The game that I learned with that company was we have no blinds. We have no physical product. We have no inventory. We have no warehouse. We have no shipping dock. Nothing. We have a virtual sale of a physical product. What that meant was, we could sell blinds. We take the order. We electronically send it to the manufacturer. They print, they make them custom and drop ship them and we don’t touch the product. If you look at that and you figure out what that means, it means you can sell something that you don’t own and you don’t even have to take inventory of the product. So, let’s take that down to the person watching this video. I like to teach on the TV shows, you can make money with no money, that’s reverse ecommerce. What does that mean? And every interviewer asked me ‘prove that to me’. So, you take a camera or a cell phone and you go take a picture of something that you think you can sell. Let’s say, I think I can sell this pair of glasses. Take a picture of it. List it on the Internet. Sell it. Collect the money then fulfill it. But if I didn’t own the glasses, I could still do the same sale. So, reverse ecommerce by definition that we define it as selling something, collecting the money and then buying it and fulfilling it but don’t buy it until you’ve sold it.

Michael: And you’ve did this yourself back in college. You have a story of how you used to visit some sorority houses.

Marc: That’s right.

Michael: Can you tell us that story?

Marc: I can tell you part of that story. Sorority, young ladies at the University of Texas where I was in college, loved their jewelry. And I knew how to buy jewelry wholesale and so I went to the jeweler. I gave them my dad’s credit card. I said, I want $3,000, I think it was $3,000, it’s in the book, worth of jewelry, wholesale. I then would show that jewelry to the sororities that I would set market up to $6,000 but…

Michael: You would physically go into the sororities, set up a table, lay out the jewelry that you did not pay for…

Marc: Correct. It was all on loan, right?

Michael: Right.

Marc: And you could do that in any business as long they have credit against it or some means to guarantee that you’ll pay it back.

Michael: Right.

Marc: So, let’s assume of the $3,000, we sell $1,500 at wholesale. So, let’s look at the numbers, you’ve got $3,000 in jewelry at wholesale that normally in a retail store will be $9,000 to $12,000, it’s not $6,000, it’s $9,000 or $12,000 because jewelry marks up bigger. I sell 3 for 6, so if I sold $1,500 of the $3,000. I made $1,500 and I returned the guy’s jewelry. He charged me $1,500. I pay it back and I’m clearing $1,500, so it’s the perfect business. That’s why people have banks to borrow money to go sell, pay the bank back and you’ve got what remains. The problem is banks won’t loan money unless you have money.

So you’ve got to convince someone, somewhere that you’re good for what you want. So I have a friend that in the last couple of days borrowed money from a friend, bought and sold concert tickets but kept all the money and never paid back the money they borrowed, that don’t work, then they won’t ever loan you money again. So, you had a great margin on that original sale but that falls down into the deal, steal or con mechanism.

Michael: Right, right, exactly. Alright, in Chapter 3 of your book, you provide 10 great reasons to own a generic domain name, which were ideal for letters to perspective buyers when you’re trying to sell a domain name. I’m not going to ask you to go over it, I just want to tell our audience that the price of this book is worth it alone for just get an access to those 10 great reasons that you can use to convince a buyer that a domain name is worth purchasing. In Chapter 4 you talked about ways to make money in advertising and pay per action. One of the tactics is called Internet Advertising Arbitrage. Can you tell us what that is?

Marc: It doesn’t exist as much today as it did, but think of it this way, arbitrage is buying low and selling high or buying high and selling low and being able to make money that way and there is way to do that with stock. But arbitrage is buying and selling simultaneously, so in the stock business, you know all the day traders would buy and sell at the same time and hope to make a dollar times a thousand shares at the same moment and that still exists to some degree but as more people figured it out the margins got thinner and thinner, so the differential wasn’t there.

In the domain space, you can literally find a buyer for domain for $100, know you can it from the other guy for $50 and do the deal and make that happen. But in Internet traffic, there still exist a differential. So, let’s assume you buy the keyword cufflinks, which is one of our companies and you buy the keyword cufflinks for $2 at Google. But I can buy the keyword “cufflinks” at a smaller search engine or from another website for $0.20 because they don’t have a lot of people competing over the value of that keyword. It doesn’t mean that keyword is less valuable because I’m buying it from a smaller guy over here and over at Google they have a lot of people that wanted it, means this guy has more traffic but it doesn’t mean that this guy’s traffic is any less valuable. This guy over here might own ABC Cufflinks and he shuts the site down but he still got traffic. So I go to him and say, I want to buy all your traffic for $0.20 a click. I then set up a domain and I’m selling the traffic over here to Google at $1 a click, because Google is selling it to me for $2. So, you have to understand the infrastructure, it ranges from the wholesale buyers selling it for, getting a free click, he sells it to me to $0.20, I sell it to the domain name, Cufflinks.com for $0.20 a click. If Cufflinks.com wasn’t using that traffic which we do because we sell cufflinks, we could have a splash page on there from Google and sell that click to Google for $1 and Google is selling it to another site for $2. But when you understand it what I did is I understood the game, I then played at every angle. I bought the domain name business. I got in the affiliate business. I got in the cufflink business, owning the site. And then I got in the site, the site where I was buying traffic and I was making money off of the other traffic that I wasn’t buying.

Michael: That makes sense.

Marc: That’s to me the way to play. It’s fun.

Michael: Right. And you actually, in Chapter 7 where you talked about affiliate marketing, it sort of ties in to this arbitrage idea. You gave an example of your friend, Adrian Morrison?

Marc: Adrian, yeah, Adrian and Anthony Morrison is a friend of mine who runs infomercials and Adrian is his brother and Adrian was playing that game at a big level. So, there are, many, if you really understand the market, there are many opportunities in between the buying and the selling, that’s where profit is made. And if you understand what’s the lowest way to buy and what’s the highest way to sell, you’re going to make money in the middle. But in the world of affiliate marketing, there are people that will pay for certain things, a buyer, a lead, any other way that they want to buy, you can find a way to sell to them and make the difference.

Michael: Right. And the trick is to know what traffic is out there to be purchased, at what cost and how much affiliates are willing to pay or how much you can make on a cost per click basis if you send it to your domain name. So, how do you figure that out? How you, like on a brand new site like Facebook, how do you figure out what traffic there is to purchased, at what cost and how much you can make…

Marc: Well, the first thing you do is if you buy the book from me, I’m going to give you free credit. I have a deal with Amazon. I have a deal with Google and MySpace and several others where we’re giving away free advertising so that people can test it. One of the, as you’ve read in the book, the best way to make a lot of money is to learn the difference between the buy and the sell price. So, if you can buy traffic cheap and you become an expert at buying eyeballs that want certain information, you can convert that data into money. So, I went and got Google and all these other sites to say give me credits that I can give away so people can learn how to buy traffic, okay? So, if you buy the book, we’re going to send you coupons good for, Drake how much is the coupon at Google? $50 or $75 bucks? It’s either $50 or $75 free use, no hidden agenda. We’ll give you a code. You log in. Get a new account and I’ll give you $50 or $75 bucks free.

Michael: Free money, go out and spend it free traffic.

Marc: You then test keywords, free eyeballs. They want you to learn how to buy their traffic and they’re so confident they’re going to give you a free sample.

Michael: So, I can go to Amazon, buy this book and have it delivered or I can go to your website GetRichClick.com, buy it and you’ll send me a free a coupon for Google AdWords and…

Marc: We’ve got over 700 so far and we keep trying to get more $700 and free coupons. They don’t cost me a penny, I just know how to get them. So, I got them and I give them to everyone who buys the book.

Michael: Fantastic. Alright, so it definitely pays for the book multiple times over.

Marc: That’s how I recommend people learn the business. We wanted to give a very compelling reason to spend 19 bucks to buy a book and make it worth that. Now you know the essence of the book gives a lot more value but that’s absolute value. I don’t know how to make it better than that.

Michael: That’s a good value. Chapters 5 and 6 talk about ways to optimize a website for search engines as well as 16 ways to attract more traffic. My fellow Seattleite and friend, Rand Fishkin, who’s the founder of SEO software, SEOmoz.org wrote chapter 6 for your book.

Marc: Yeah.

Michael: It’s a fantastic guide to search engine optimization. It really is a wonderful read.

Marc: Do you know Rand hasn’t seen the book, you might tell him. We got permission, they have so much good information at SEOmoz that I found this and edited out what parts I thought were valuable and said, can I use this, I’ll give you complete credit. And we put it in the book as a whole chapter because it was that good.

Michael: It is good, I will attest to that. Okay, so you’ve got a whole chapter just devoted to domain names, which is near and dear to most of the DomainSherpa.com audience. We discussed your sale of Business.com in the introduction. On page 122 you say and it’s a quote, ‘with the possible exception of international domain names, a buy and hold domain name strategy will not work today in a majority of cases’, why is that?

Marc: Wow, that’s an interesting comment, it’s an interesting question. The answer in my opinion and I’m not giving legal advice here, let’s be clear. I’m a believer in one word generic domains, mutualfunds, I will call heartdisease one word, consulting but below that one or two really unbelievable generic keywords. You’ve got multiple words, so let’s take cufflinks.

We own Cufflinks.com but there are several thousand other domains with the word cufflinks.com. Then you’ve got other top level domains with the word cufflinks, now you’re going to have, not even the top level domains but the secondary domains and the international domains. What’s happening is, in an old world where real estate was confined, let’s back up Aspen, Colorado is so incredibly valuable real estate because they cannot build their land lock.

This is the city. They can’t go this way and they don’t allow them to go this way their land locked. The real estate will always be valuable unless there’s some other contamination reason because they can’t build. Vail, Colorado is this big but they continue to grow because they can, you know there’s more room to grow up the mountain and across the mountain and down the valley, so it’s not as valuable real estate. The domain space, this started as .com then .biz, .info, .org, now it’s this big, now it’s this big and this is going to be so big it’s off the screen, the value has to drop because there are so many people competing. Let me give you a question that most of your people never thought of. What happens if Google enables and finds a way that when you type in the cufflinks, it automatically goes to cufflinks.google? And Google owns it.

And Google sells that traffic to someone at a higher price. The possibilities for what Google could do to wipeout the domain market are staggering. But the reality is, I don’t think that’ll happen anytime soon but we are a believer that .com is the gold standard and no matter what you add if there’s someone advertising a .moby, .com is going to get some of that traffic because people are still attuned to .com. The younger crowd as they grow up will start to be used to using the other top level domains and that in essence will make that market flourish that much more. I’m not a believer to invest your savings in a big chunk, in a group of domains that are not .com or maybe .biz and .info. I’m a big buyer of biz and info names because I believe those are still undervalued. And I like the .info and .biz category quite a bit. I don’t own domains in .moby. I do own .eu because the European Union was like an 800 number overlay for Europe. And so I bought .eu, I bought .info, I buy .com and .biz.

Michael: Okay, so you own the domain name mutualfunds.com. It’s a fantastic domain name. It’s parked that looks like it’s parked, it’s got some ads on it. I’m amazed that no mutual fund company has purchased it from you.

Marc: You know what?

Michael: Why is holding that domain name still a good idea? According to your reasoning…

Marc: Because that is the name of an industry and it’s a .com. So I own the name of the industry and it’s a .com. If you’re going to hold anything, to me that’s what you hold.

Michael: Okay.

Marc: So, if you buy a car, the top 30 brands don’t go up in value, but if you buy a Ferrari, it might very well go up in value. Your odds of going up are the top echelon small percentage, and I’m a believer in most markets, the better piece that you own, you’re better off owning the smallest house on a valuable street. You’re better off owning the one word generic .com versus 50 non generic .coms in that space.

Michael: I understand what you’re saying now, okay. So, some domain names are worth holding but if it’s not an industry defining domain name that will appreciate over time it might actually depreciate when Google buys .google or .mutualfunds get released or what have you.

Marc: I think without a doubt that’s the case. Now, you know there are always exceptions to the rule, but in my world, I don’t play in these other spaces because it’s too speculative. Now, if you get in on the land rush and if you get the word hotels and if it’s in a .moby, hotels.moby is valuable. Or hotels.russia or hotels.japan. Those kind of things have value. Are they a hold? Or are they—you better sell it soon because at some point it’s got a value change because someone else will come in.

Michael: Right. Understand.

Marc: That’s my belief.

Michael: Yeah, okay on page 118, you talked about Frank Schilling being a success story. I think Frank is sort of the poster child for success stories. He owns 380,000 domains. He started buying them when they weren’t valued and he went, you know, all in. His portfolio is now worth $350,000,000 to $500,000,000 because he had the vision. Clearly Frank took an enormous risk, tremendous businessman. But isn’t Frank just success remnant of the past? Can someone repeat what Frank has done today?

Marc: No, no, they can’t, not with the current market. If something else happen they could, if you get…

Michael: What would that be?

Marc: Okay, so, I like to play in games where I have a competitive advantage. Venture Capital backs people that have a competitive advantage. If you and I went in with a business plan and you had the bestmutualfunds.com and I had mutualfunds.com and we had everything else the same, I’d get the backing before you would.

So, competitive advantage is key. When .biz and .info came out, I didn’t want to play the game that everyone else played. I actually became a registrar and then got the name. So, Go Daddy submitted 200,000 and these aren’t real numbers, 200,000 and Network Solutions said I want 50,000 and someone else said register.com so I want 300,000. I put in my application for 200. So, they went around the way the computer gave them out, you like a deck of cards, you get one, you get one, you get one, you get one. After the first round of 200, I was out the lottery and I got 180 of them. They got 180 random wins, I got the 180 I wanted because I understood the system. Now, take that knowledge, you now, anyone who has watched this has learned it. Now how do you apply it? Even though you didn’t do it, how do you take my knowledge and benefit from it? If you can create a competitive advantage situation in the domain space that could be valuable, you could make some big money. The only way that I think you can do that is A, there are many ways, but the ways that I would see are lock up a bunch of domains in a category at certain price and flip them to someone for a package, do the work to lock up mutual funds, growth funds, this funds, that funds and go sell the package and have a guaranteed buy price and then go sell it for higher than that. Or let’s say, you believe you have had an in and a good relationship to get .hotels and you want to submit to own .hotels because you see the vision that you can take that, you’ll own it and then you can parcel those out and make a lot of money. So you apply to get .hotels in the upcoming I can game, because I think I can really screw the world by the way. If you can create a competitive advantage situation, you can make the big bucks fast, but the odds of creating that are slim because everyone is thinking that way. I’d rather see you buy and sell, buy and sell, getting really good at a particular niche. You say to someone who is looking for financial traffic, I can get a lot of financial traffic from these assets and let me buy them and sell them to you. I had a guy that was selling me domain names when I was partnered with Howard Schultz at iREIT and he was a poker player, some of you know him and he was literally one of the world’s best poker players and he’s a domainer. But he knew odds and knew numbers a lot better than anyone I’ve ever met. And every three to four weeks he’s sell me 20 to $40,000 worth of domains that he had bought because he knew how to buy them and he knew the multiple we were paying and he could buy them and flip them, buy them and flip them all day long, take the spread and go gamble with it. And he didn’t hold them, he split every time. Everyone’s got a different competitive way to play the game. It’s all about knowledge and competitive advantage.

Michael: Definitely. Alright, Marc I would be remiss if I didn’t talk about failures. You know, we talked about your success, you’ve sold so many companies, you started so many companies, you’ve been on the winning end but every entrepreneur experiences failure, no matter what. Anyone who says that they don’t, they’re probably lying. The key is how they overcome the failures. What business did you think was going to be successful but ultimately failed and what do you think learn from it?

Marc: I started a tradeshow company called The Home and Family Computing Super Show. It was a tradeshow, it was CES for consumers. I knew that when I went to CES, it was a kid in a candy store and everyone I talked to said, I’d love get in to that show.

So, I came back and I got Microsoft. I got Ziff Davis which is a publishing company. I got Apple, HP. I got all the majors to agree to support it and sponsor it and then I would go around the country and I held shows. So, I put together this amazing show, it was come see, touch, feel, and play with the latest in technology, still sounds good today.

Went to all these convention centers through this amazing show. And for those four days or three days times four cities which is 12 days, I made really good money. I had the sponsorship. I had the computers that were given to me. I had the software. I had exhibitors. I had attendees paying to come in the show, everything worked. But I didn’t plan that the day after the last show, I would have 11 months before I have another show times 15 staff.

And so one month later there is $30,000 in staff. And another month later there is $30,000 in staff or it’s actually $45,000. After three or four months of this I’m going, oh my god, I got a real problem here. And I had to shut the whole thing down.

Now, I shut down because Ziff Davis said that was such a good show, we’re going to our client Microsoft and we’re going to launch a competitor. And what happened is they split the market. So, at the same time, I had created a grand slam winning hit. Ziff Davis competed with me by getting Microsoft to support them, they had a better relationship with Microsoft than I did. And the funny thing was we killed the tradeshow the same week. We both split the baby in half and said we can’t make it work and the decision was to pull the plug and on a Monday, I announced it, on a Wednesday, they announced and there was no show. Where there was two shows now, there was no show.

Michael: Right, unbelievable.

Marc: It was really a shame.

Michael: And so you learn the importance of cash flow in that business?

Marc: It was cash flow. It was planning. It was management. It was looking ahead. It was planning what’s a three month plan, a six month plan and you don’t plan the income as much as you plan the outgo. So, many people plan their business plan and they don’t do the numbers.

That’s complete bullshit. If you give me a business plan, it’d better start with the numbers. People don’t do it and it’s amazing how many people come to me and they haven’t done the numbers and they go I’ve got them in my head, no, you don’t. What the, the most of them don’t do is put in the value of themselves. So, you got entrepreneurs that write business plans, have they put into that business plan how much they would make if they work somewhere else. If you’re worth $100,000 at another job and you do two years, you better put in $200,000 because that’s what you’re giving up by not working somewhere else. But they don’t, you know, you got to live and learn.

Michael: Yeah. Aright, we’ve only got a few minutes left with you. Let’s see, okay, here’s how I want to end the interview, last question. Too many people have an idea, they spend five minutes researching it on the Internet only to discover that somebody else is doing it already, then they give up. What advice do you have for that person in that situation?

Marc: I don’t agree with that at all. If someone else is doing it, they’re doing because it makes money. So, don’t give up if they’re making money, that’s a good sign not a bad sign. You just have to be better at it than they are. There are so many ideas that people come to me with but it’s the implementation of the ideas that really works. Know what you can do, hire your weaknesses, know that if other people are doing it, it’s probably making money and if you stick with it, you’ll learn fast enough especially in the Internet world, what’s working and what’s not working and you’ve got to know what you don’t know.

You can go into this thinking you know how to do something and not know it and then have to hire someone to do it which cost time, which cost money, which just means you’re not doing something else. You know I always laugh people say, my wife spends a lot of money. I say, does she have job? They say, no. I said, if you get her a job, she’ll spend less. They say, why? I said, because she’ll be so busy, she won’t have time to go spend as much.

So, if she’s not working, if she spend the money and she’s not working, that’s biggest outflow you’ve got. If she’s working and spending money, you’ve probably got less outflow. And if she’s working really hard and she understands the value of money, both things are working for you. It’s exactly the same in all the business context that you’re dealing with. You got to get spend less and make more and create that spread in whatever it is you’re doing.

Michael: Right, makes sense.

Marc: And planning is the ultimate key. And learn as much as you can from other people’s mistakes. Why not read about it and then know that’s a good idea or on this $75 free with Google, use that to test. See if you spend that correctly. Why would you go spend real money when you can get 75 free dollars? It’s using what’s out there and thinking about it.

You get really good at it really quickly as an entrepreneur and you know. When we started this call, you had 20 things you had to do because you knew from past things I’ve got to make sure the lighting is right. I’ve got to make sure the audio is right. If you were starting out, you wouldn’t do those same things.

Michael: Right. Yes, great advise. Alright, here is the book again, Get Rich Click, the ultimate guide to making money on the Internet. Your web address where people can go and learn more Marc is GetRichClick.com. It’s available for preorder on Amazon right now. It goes on sale May 2nd. You’re on Twitter. You’re on Facebook. What are those handles Marc?

Marc: Oh, I think they’re both Get Rich Click aren’t they?

Michael: Get Rich Click.

Marc: Get Rich Click.

Michael: Okay, Twitter slash, Twitter.com/getrichclick and Facebook.com/getrichclick. Marc, thank you so much for taking the time and doing the interview with me today.

Marc: Always enjoy it. Anytime we can talk, let me know.

Michael: I appreciate it. Thank you. And guys come back to DomainSherpa and give me your feedback. Type your comments and question at the bottom of the page and we’ll see if we can get Marc to answer a few of them. Thank you all for watching. I’ll see you on DomainSherpa.

Watch the full video at:

https://www.domainsherpa.com/marc-ostrofsky-getrichclick-interview

[Photo credits: Marc Ostrofsky]

If you enjoyed this article, subscribe for updates (it's free)

Be Interviewed on DomainSherpa

Be Interviewed on DomainSherpa

Very informative Mike thank you so much for another great interview!

Michael….

Great interview. Can’t wait to get Marc’s book!!

Thanks….

Eric Jenkins

A fantastic interview, can’t wait to read your book. I need to change my mindset.

Some updates for everyone. Get Rich Click is doing phenomenal right now as it has made the New York Times bestsellers list again!

If you haven’t already seen it, check out my interview on ABC’s “The View.” http://www.getrichclick.com/vw

Also be sure to read my Times Magazine interview on how I got rich “click.”

http://www.getrichclick.com/timemag

Finally, you can get 2 FREE chapters of my book at http://www.getrichclick.com/2

Hey mate, thanks for writing but this article isn’t vewable when using IE it is is overlapping.

Thanks for the heads-up, Louboutin. I’ll look into this immediately.

In the meantime, a band-aid solution is to try Firefox, Chrome or Safari. The site displays properly in all these browsers.

Michael,

A big thanks to you and Marc for a fantastic interview!

I will be getting the book for sure!

Cheers, Mars

Surely, buying the book and then selling the coupons, if you’re not going to use them, would result in a net gain, and a free book!

Its a great interview and $20 bucks for knowledge is a good value. Just curious if i could have it shipped to Malaysia.

@mano

They don’t ship to that part of the world but if you contact me, I can do it for you.

I have shipped this kind of stuffs to Thailand/Msia ,Indonesia and Singapore.

I have shipped a mini yacht to Brunei.

Michael,

Great interview. I will be sure to get this book not only for its valuable information, but for the Google ad coupons as well.

Thanks!

Thanks, Kristin. I’m glad you enjoyed it!

The book really is great. I think you’ll get a lot out of it. I know I did.

I remember seeing Marco Publishing in the whois registrant field of many high quality .biz and .info domain names. I happen to agree with Mark about .biz and .info space being undervalued. Their adoption has grown with each passing year.

Historically, that Business.com sale energized the domain industry. A remarkable precedent was set. It captured my attention.

Great point. Marc opened up the industry and made Internet real estate more valuable – for all of us – as a result. It sounds like he’s a pretty awesome business leader to boot.

Great interview!

@Marc,

Those domains (i.e. Asia.com, Venice.com, Houston.com, etc) you mentioned are virtually impossible to acquire. You’ll need deep pockets (your money) to acquire such domains. Even if you have the money, the owner may not sell these domains.

Any region, state, country, and generic industry domains are untouchable domains unless you show the money. There are some industry leading domains available on a few domain sites, but they will cost in the 6-7 range.

Nonetheless, I don’t mind that I can’t secure an industry defining domain name. I’m cool with the domains I own now.

Thanks for responding to the industry question.

JAG

@JAG

I had a dream last nite that there will be a technology aka domain meltdown and all the domains are wiped off from the face of the Earth.

No records of who owns what!!!!!

Whopeeeeeeee….domain judgment day will come sooner than later!!!

There you go, WE STILL HAVE HOPE.

What I don’t understand about dropshipping is if you sell binds on your site, take orders, etc., aren’t you liable if there is a lawsuit if a child dies of choking?

Hi Chris,

I don’t know any of the details of how Blinds.com is set up, but I would suspect that any business that buys product from one company and then sells to an end user will have some sort of indemnity agreement with the manufacturer. That doesn’t prevent anyone from filing a law suit against you, of course, but it helps. In addition, I’m sure Blinds.com has insurance just as any other business does.

Mike

You can count on me for a book purchase (or three), Marc. It’ll be a great study during my long, daily commute. Thanks for taking the time to share your superb insights with us.

And thank you, Michael, for conducting such an outstanding interview.

Gene

Nice interview… Thanks for taking the time!

Pre-ordered a couple books @ amazon.com to give out to friends who could use it. Look forward to reading it as well.

+1. Bought on Amazon. I’ll have it the day after it releases. Can’t wait! Based on video, it sounds great.

“Because the book is not about money. It’s about TEACHING others how to do it.”

I guess this is noble effort then which is nice to see. Will you be distributing it in ebook form for free for people in developing countries who are looking to get started online but where $20 is a lot of money to spend on a book?

Fun and informative interview. It’s great to have “access” to Marc like this. I’ve only read about his success.it’s fantastic to hear from him directly without having to go to a conference. And no more of those canned presentations.

Who’s next? I can’t wait!

Thanks Brett. Happy to interact with you all. The book will be a BIG deal….so if you get a copy at Amazon.com, I am hoping guys like you will tell everyone you know that IF they want to make money online, THIS IS THE BOOK.

It’s THAT good….I will guarantee that. I have too much riding on my reputation not to put out THE BEST BOOK on the subject. marco

I really like your advertiser Page 2 Sucks! It’s like a Stackoverflow for SEO stuff. I’ll check that out after I’ve watched the interview.

Awesome! I hope you enjoy Page2Sucks.com and it helps you improve your site SEO.

Thanks Michael. Gets better each time. Thanks also to Marc for giving freely of his time.

Thanks, Garry.

Awesome interview again! Thanks Mike for your hard work. Good to hear from the one-time owner of Business.com. Congrats on your success Marc.

Your advised domains to retain names of an industry. Is that referring to domains like JobIndustry.com, ResumeIndustry.com and WritingIndustry.com? I own the second two domains, and I believe Frank owns the job domain above.

Very informative interview from an innovator. Thanks again for the information.

JAG

Thanks, Jason.

That’s a good question. I think Marc was referring to domains like MutualFunds.com or Apartments.com when he made that comment. I’ll ask him if he can clarify that point.

Yes Michael, I was referring to THE name of an industry ie, MutualFunds.com or CuffLinks.com or Blinds.com. If you can get a COUNTRY or CITY name like Houston.com or ASIA.com or Venice.com, those too have good, long term viable income streams.

BUT, a lot of these high value names are NOT in use and it’s easy enough to say I can build it out and share 50/50 with the domain name owner. You invest ZERO in the name and get 50% of the revenue (over current PPC income) by building it out, running the site and getting to split in the income. Then try to get a piece of the “increased value” on the sale of that asset if/when sold.

marco

Business.com is the proud sponsor of BullS site.

thank you very much

I doubt that, Chris. :) But I am proud of our new DomainSherpa Sponsors that just came onboard. Check them out and show them some love. They’re supporting our work here at DomainSherpa and allowing us to continue to do what we love doing.

Congrats on the new sponsors. Don’t forget guys like me who provide valuable content on your site!!!

Loved this interview! No offense to the past interviewees, but I think this is the best one yet! They just keep getting better and better, Michael.

Marc, do you have any idea what the total amount you’ve made off of domain names? $10M for business.com, $10M for ebusiness.com…what else? Just domains, not websites + domains. It’s fascinating.

Thanks again!

Thanks, Chuckie. You know what they say about practice. :)

It’s hard to make a serious answer to a person names “Chuckle” :)

About $20 Million or so. Biggest were Business.com and eBusiness.com but I sold a few others along the way.

The or a BIG opportunity is for a PROFESSIONAL firm to start taking $1 Million+ value names and sell them for 15% of the total. There are 500 or so of those names NOT in use, I have 12 or so…that are awaiting an “investment banker” type to sell them off. When anyone finds such a “broker”, let me know.

MarcO

I really enjoyed the interview. I didn’t watch the video only read the transcript.

Marc’s explanation on buy/sell traffic was brilliant. Not sure I understood everything.

But I think I learned a lot. Definitely want a copy of his book! Thanks!

Thanks, Poor Uncle. It’s a great book…I can vouch for it.

What didn’t you understand from Marc? Please ask a question, and I’ll try to get an explanation from Marc.

Well he touch on a lot of area in the web business. He was giving a lot of information in different area of the game. Wasn’t sure if the stock put option he talked about related to the Internet game or was specific to his business.com deal. I think he is brilliant with an over grasp of the Internet business. He mention a lot about hiring your weakness. My one question to him would be how can someone succeed in the web business if he is mediocre and lacking in cash?

TRADE, BARTER or just ASK.

People ARE willing to help entrepreneurs if you are VERY upbeat, positive and can back up your ideas with numbers, graphics and charts showing you know what you are talking about. The word “help” works great. Can you “help me”…is THE BEST line ever to get help – free or be referred to someone else.

The “put” right was when I sold Business.com. I got a “put” right meaning I can buy back into the company at a specified later date for a specific amount.

Good luck to you.

MarcO

I never understand things like this…. has over $100M in sold businesses, current domain portfolio/websites generate $75MM a year according to this article, and he is selling a book for $19.95?

19.99 is too much or too low?

@Chris,

Marc’s not writing the book for the money. Very few authors write for the money.

Authors write because they love to write, or want to record something forever, or — I suspect in Marc’s case — have life lessons and experiences that they wants to share with others.

Writing is a noble endeavor. Writing a book of this quality and depth (I’ve read it cover to cover) is no easy task.

Because the book is not about money. It’s about TEACHING others how to do it. I may clear $2 a book…not worth the time in most cases but my way of giving back to an industry that did really well by me was to write down all of the amazing things we learned in “how to beat the system” and actually make money. The internet is THE greatest “home field advantage” ever and the book teaches 100’s of ways to play the game and win the game. That’s why!

I was reading about him before and saw his videos on YouTube as well. Great interview.

Thanks, Gnanes.